Although it’s not law yet, the tax ring-fence for rental property losses is likely to be approved and will apply to the current tax year, but CoreLogic Senior Property Economist Kelvin Davidson doubts it will dramatically change the rental property landscape

The proposed tax ring-fence for rental property losses isn’t in force yet, but it is currently going through the ‘bill to law’ process – which starts with a select committee and then ends up before Parliament for the final stage. It would appear though that this is a mere formality and that when it becomes law the ring-fence will effectively be imposed for the current tax year starting 1st April 2019. In other words, investors need to be accounting for the ring-fence now – i.e. running their sums on the basis that a rental loss can no longer be used to reduce the tax bill on non-property income(s).

Certainly, some investors (especially those new to the game and/or with a big mortgage and hence greater likelihood of a loss) will be hit quite hard by this rule. But on the whole, we’re doubtful that the ring-fence will dramatically affect investor confidence or significantly reduce the stock of property in the rental sector.

First, because of the loan to value ratio (LVR) restrictions, investors have required a deposit of at least 30% for several years now and, on average, will be less likely to be making operating losses than in the past – hence, less likely to actually be utilising the tax advantage. Sure, many will still be using it. But it’ll be less common than in the absence of the LVR rules. Second, and perhaps most importantly, it’s a ring-fence, not complete removal. Investors will still be able to use losses to reduce their tax bill, just only within a property portfolio, not against non-property income.

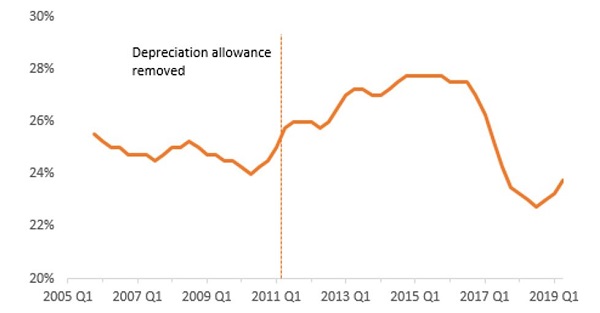

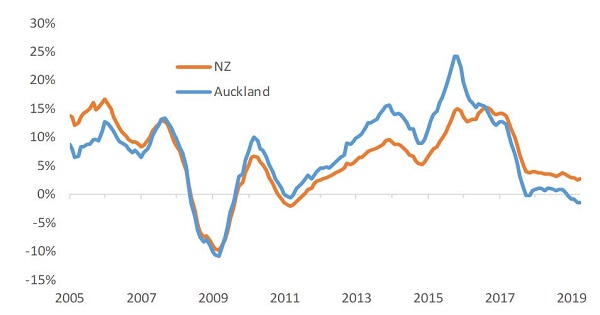

It’s also reassuring to look back at investor behavior when the depreciation allowance was removed in April 2011. This was also a significant change in the rules around property investment, yet our Buyer Classification figures show that the upward trend in the share of purchases going to mortgaged investors barely paused for breath (see the first chart below). To be fair, property price rises more generally were starting to kick into gear again around that time (see the second chart below), and these gains may have swamped the effect of removing the depreciation allowance. And clearly, that factor isn’t as strong now, with values flat or slightly falling in Auckland and Christchurch for example, and slowing in many other parts of the country.

Mortgaged multiple property owners’ % share of purchases (Source: CoreLogic)

Annual % change in average property values (Source: CoreLogic)

All that said, another factor to keep in mind here is the tighter availability of new interest-only loans in the past few years, as well as the reduced ability for investors to roll over existing interest-only lending. Given that interest-only loans (and hence lower mortgage payments) are an important tool for negatively geared landlords, it’s conceivable that some will have already looked at their sums (regardless of the ring-fence proposal) and decided to sell properties that don’t stack up anymore. This may have affected rental supply in some areas and would be another factor helping to explain the gradual slowdown we’re seeing in property values around the country.

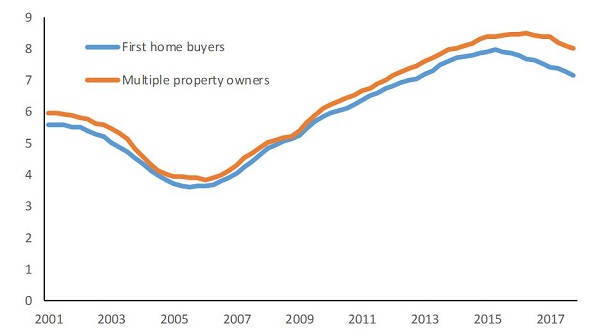

Of course, this would only serve to lessen the potential effect when the new law does actually come into force. Moreover, let’s not forget that just because a landlord sells their property, it doesn’t necessarily vanish from the rental stock – it may well be snapped up by another investor, perhaps with more equity behind them. In addition, rather than selling, landlords may just hold their properties for longer than they planned in order to compensate for the effect of the ring-fence on their expected return. That would just reinforce what we’ve already started to see in the past year or two – that is, investors holding for longer than in the past, and also relative to other buyer groups, such as first home buyers (see the chart below).

National median hold period in years (Source: CoreLogic)

Bottom line, we doubt that the looming tax ring-fence for rental property losses on its own will drive a sea-change in investor behaviour. It’s only a ring-fence – property losses will no longer be able to offset non-property income, but they can be used to lower tax within a property portfolio. Some investors will undoubtedly be hit quite hard by this. However, other equity-rich landlords may just snap up any sold properties, therefore limiting any adverse effects on the stock of available rentals.