By Elliot Jones and Julian Sinke

The refrain among business owners as 2024 has elapsed has been “survive ‘til ‘25”, and in the Christchurch industrial market, the decision-making has reflected a realistic mindset.

We have been advising and working with owner-occupiers who are rationalising their holdings in a flat market, guiding businesses to find the right warehousing and office solutions where availability is scarce, and helping everyone in a given transaction understand mutual expectations in a market no one has quite experienced before.

Despite the recession there have been plenty of success stories, and as we look ahead to next year there are signs of green shoots, not least because many business owners are making smart calls to get through the rough patch, and large-scale infrastructure investment – including in the major new stadium – is set to pay off. In short, there is cause for optimism.

1. The industrial market has stayed fairly flat over the last 12 months, with businesses taking a conservative approach, and the “as is where is” opportunities largely drying up. Investors are looking for creative ways to add value to purchases, and while low vacancy and low rates of new builds have put upwards pressure on rental rates, insurance increases are affecting operational expenses and helping to flatten rental rates. The upside is that most vacancies are filled reasonably quickly, ensuring a low rate of stagnant stock.

2. Low vacancy throughout much of Christchurch, particularly for businesses seeking medium-

sized warehouse or office solutions; it takes more time to find the right properties. Supply depends mostly on location and size. Currently there is little vacancy in the inner city and fringe but a range of sites available for lease in Rolleston that are built and ready to go, with further projected builds in that area that will help mitigate demand. The challenge we are managing is around having the right stock for the right client at the right time.

3. In the near future the city will face challenges around the supply of small to medium industrial units in the city fringe. Inner-city growth of residential and commercial developments is starting to push out to the industrial areas. The associated higher returns for investors will cause industrial to either move out further or meet new market rates, and force them to look for alternative spaces and/or compromises. However, there is a lack of supply of available appropriately zoned land and also development of small to medium warehousing. This all might lead to challenges for warehousing requirement and also upward pressure on m² rates.

4. A number of clients in owner / occupier sites are looking to lease out their sites and move to smaller or cheaper properties. This reflects the pressures that businesses of all sizes are feeling with increased costs amid the economic slowdown, and we are supporting them as they manage their cashflows. At the same time, we’re seeing more investors and developers searching for new investments and spec build opportunities. Multinational companies have been looking around Christchurch to set up here and get

greater operational stability due to transport pressures between the North and South Islands.

More Christchurch-based trades companies are looking to expand their businesses into larger warehouses, and we are seeing construction associated with anchor projects in Christchurch. These promising signs show the resilience and creativity of many New Zealand businesses.

5. Stock levels remain a primary consideration, particularly around the available industrial land of the smaller size of 1500m ++ in the desirable areas. There is also more demand for than supply of small- to medium-sized warehousing. There has been a slowdown in demand for larger sheds, particularly for transport/logistics operators, with a number of sub-lease opportunities coming to the market as of late.

6. The state of the economy means larger logistics sites in high-demand areas are taking longer to lease. In recent times we have developed alternate solutions for sites like this (multi tenancies, retrofitted works to accommodate a different industry), but budget- consciousness among business decision-makers currently means older properties are attractive for a lot of companies as they can get the space they want. They are compromising on location or quality but benefiting from the lower rent while they work through this tough time.

Predictions for 2025:

i. Slowly decreasing interest rates, rising business confidence, and the desirability of Christchurch business means we expect to see an increase in demand and speculation for Christchurch, where key infrastructure serves the city well and makes it a transport hub and effective gateway to the South Island. Lower debt servicing costs and swelling confidence will drive investor interest in existing and new property.

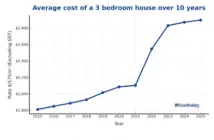

ii. Christchurch is increasingly seen as a desirable city in which to live, and as interest rates start to ease, home ownership affordability will rise and disposable income will increase. This will help drive up business confidence, create opportunity for growth and entrepreneurship, and power the economy back into a growth state.

iii. Investors will seek ways to achieve higher returns from their portfolios, shifting money from fixed interest investments to higher-yield investments like property, businesses, and shares. These economic indicators will bolster the industrial sector and help Christchurch retain its status as a great liveable city.

iv. One New Zealand Stadium at Te Kaha coming online in H1 2026 will have an interesting impact on the eastern frame of the city, in the industrial belt between Barbados Street and Fitzgerald Avenue and even further. At minimum it will likely drive a large increase in land value, affecting the rate of return required.