The value of New Zealand’s commercial property sales so far this year is lower than recent years, but this isn’t a surprise, says the November Research Report from Colliers International.

The aggregate value of New Zealand commercial sales for the 10 months to October 2017 reached $4.5 billion, made up of 2,099 sales.

At the same time last year, sales were 73% higher ($7.8 billion), and the year finished at $9.6 billion of total sales.

Investors this year have been purchasing assets at the higher end of the value spectrum ($5 million and more) accounting for over 63% of total sales value. There has been a corresponding decline in the $2 million to $4.9 million segment.

Auckland unstoppable

Auckland continues to be the dominant force, accounting for 59% ($2.7 billion) of all commercial sales activity by total value so far this year, eclipsing the other main centres.

Canterbury grew to 12% ($522 million) and Wellington dropped to 6% ($270 million). Hamilton and Tauranga continue to be the regional hotspots.

Industrial sector still a favourite

Industrial property is still the favourite among investors, making up 38% ($1.7 billion) of the total value of commercial sales so far this year – 52% of which have transacted in the $5 million plus price segment.

The proportion of office sales is 26% so far this year, compared to 22% in 2016 (full year). These increases come at the expense of the retail sector, which has struggled both in total value and volume, reflecting sluggish dynamics in the retail market

A new phase of the cycle

The availability of prime assets for sale will continue to be scarce. 2016 saw some of the largest commercial sales ever, including the sale of The Millennium Centre in Auckland at $210 million.

Sales in 2015 were even stronger peaking at $10.5 billion, with the big ex-Westfield shopping centres changing hands.

Against that backdrop, the decline in sales volume and value expected this year should not be construed as a lack of investment appetite. The reason is simply the lack of assets for sale.

Demand for investment remains buoyant. When a quality asset is offered for sale, there are usually multiple bids, there are just not enough to go around.

The new government is tightening rules around foreign ownership of property and land. While the suggestions so far have mainly been concerned with residential and farms, overall property sentiment is bound to be affected until details are known.

ANZ’s latest Business Outlook survey for October 2017, shows a marked increase in sentiment around residential and commercial construction. Most survey responses were received in the first half of October before the final government coalition was decided.

The residential construction index moved up to 31.3 from 17.6 a month ago, while the commercial construction index moved up to 42.8 from 17.7.

Office

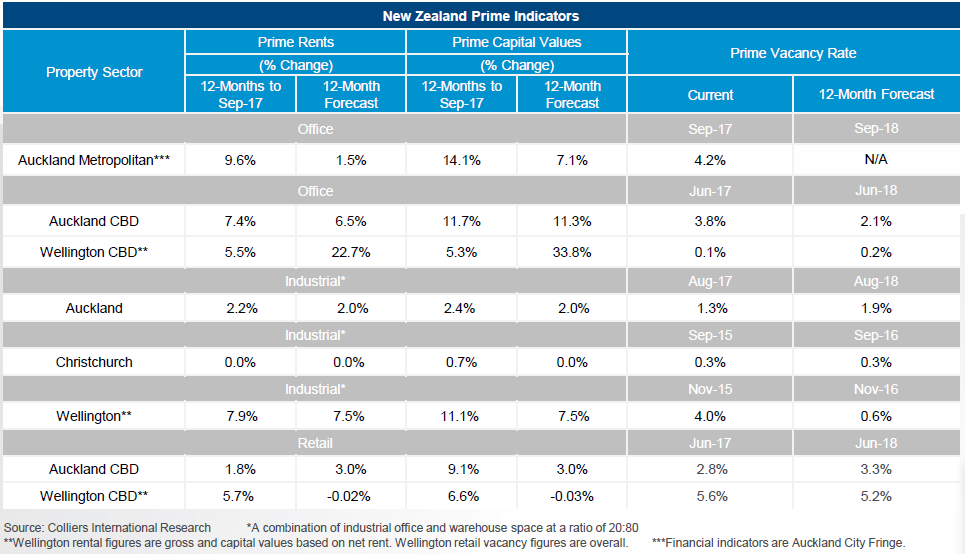

Our Auckland metropolitan office vacancy rate for September 2017, has reach record lows reducing to 5.1% overall with prime at 4.2% and secondary at 5.4%.

Precincts such as City Fringe and the Southern Corridor have experienced the largest reduction in vacancy with take up of space in the Cider Building, Millennium Centre and properties along Carlton Gore Road particularly notable.

The strong demand for metropolitan office accommodation has led to only 87,000 sqm of available stock, the lowest in eight years. This despite over 22,000 sqm of new prime office supply across five buildings being completed in 2017.

Developers that had the foresight and ability to absorb higher levels of risk and plan for this a few years ago, are now receiving strong enquiry for their new premises.

Landlords are also undertaking building refurbishments and upgrades to capture higher rentals and longer lease terms.

Retail

Retail sales in New Zealand rose 1.4% ($309 million) in the June 2017 quarter. Accommodation and food and beverage services had the largest increases in retail sales at 4.9% ($117 million) and 4.6% ($47 million). The increase reflected the influx of visitors for the World Masters Games and the Lions rugby tour held in New Zealand during the June quarter.

On a year to year comparison, all regions have experienced an increase since June 2015. Waikato had the strongest growth at 7.1%, followed by Auckland at 6.3%, Wellington at 6.2% and Christchurch at 2.4%.

Based on previous years, retail sales across all regions are expected to see a boost of around 12% to 15% around the Christmas period.

Industrial

The seasonally adjusted BNZ – Business NZ Performance of Manufacturing Index (PMI) for September 2017 was 57.5 (a PMI reading above 50.0 indicates that manufacturing is generally expanding; below 50.0 that it is declining). This was 0.4 points lower than August figure, but 0.3 points higher than the September 2016. The manufacturing sector has remained in expansion since October 2012.

In the last month, the employment index declined 5.9 points to 50.7. It is likely manufacturing firms were holding off on hiring until the new government was announced. In addition, firms have reported they are still hunting for employees but are having difficulty finding skilled staff. J.P. Morgan released the Global Manufacturing PMI for October 2017 (note: a different measure to BNZ). New Zealand (57.5) is currently above UK (56.9), Australia (54.2), US (53.0), Japan (52.6), China (51.6), and behind the Eurozone (58.2)