Median property prices are up slightly, agents are reporting more first home buyers on the market and increased attendance at open homes and auctions in some regions

“Agents are seeing more first-home buyers and busier open homes. Nonetheless, the latest nationwide figures confirm we’re not seeing the normal sales lift associated with spring,” says Tim Kearins, Owner of Century 21 New Zealand.

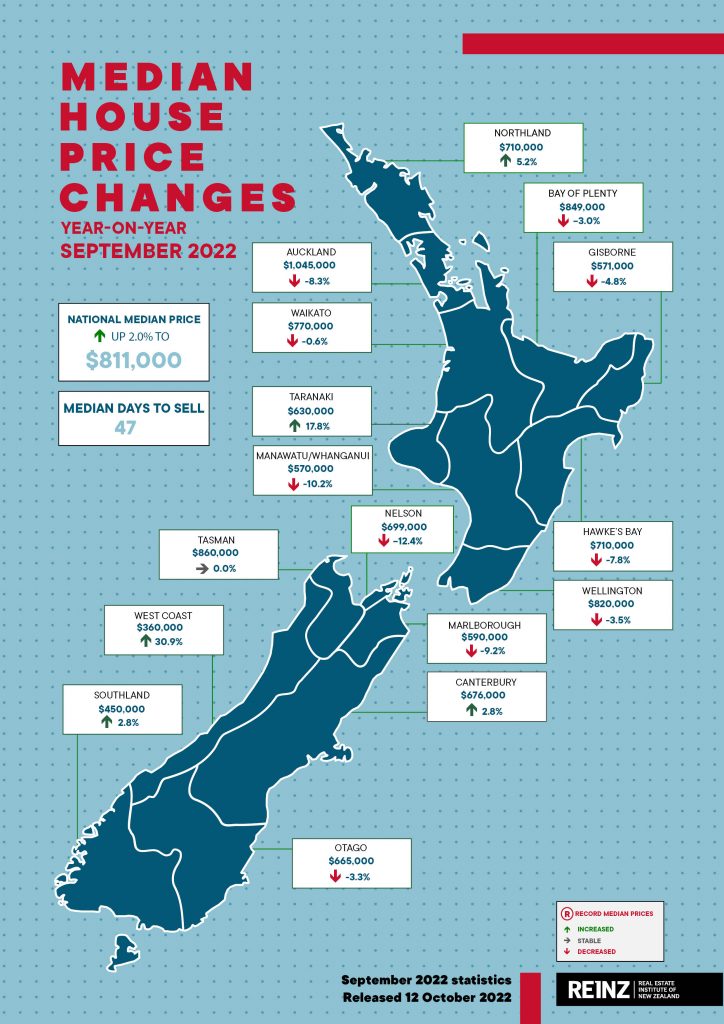

Kearins’ comments follow REINZ releasing its Monthly Property Report for September – a month which saw median house prices across New Zealand increase 2.0% annually. At $811,000, the national median house price is up from $795,000 in September 2021. Month-on-month represents a 1.4% increase compared to August.

REINZ says while the median property price shows a slight increase nationally, sales activity is down, and properties are staying on the market longer with median days to sell high and inventory levels elevated.

“Buyers are cautious this spring, which is expected with increasing interest rates, cost of living pressures, and ongoing struggles for many to secure a mortgage. As REINZ, has stated, this is not going to change much in the foreseeable future,” says Kearins.

“Across New Zealand, the number of residential property sales in September decreased annually by 10.9%, from 5,548 in September 2021 to 4,943. At the same time, the total number of properties available for sale nationally increased by 93.2%, from 13,407 in September 2021 to 25,903. Month-to-month listings were up 5.2% compared to August.

“Listings are up as we move into spring which is somewhat encouraging. Kiwis still want to move house, and with less on the market to choose from, many good properties will keep commanding good money. In my observation, the top end is probably holding its own better,” he says.

The Monthly Property Report follows the recent release of the REINZ & Tony Alexander Real Estate Survey for October, which concluded despite concerns, buyers are showing signs of returning.

The monthly survey of real estate agents also reported the return of first-home buyers and improving open home attendances. FOMO (fear of missing out) is now low, and buyers remain concerned about high interest rates and access to finance.