JLL explores how the office, industrial and retail property markets have been tracking over the last quarter and what we can expect going forward

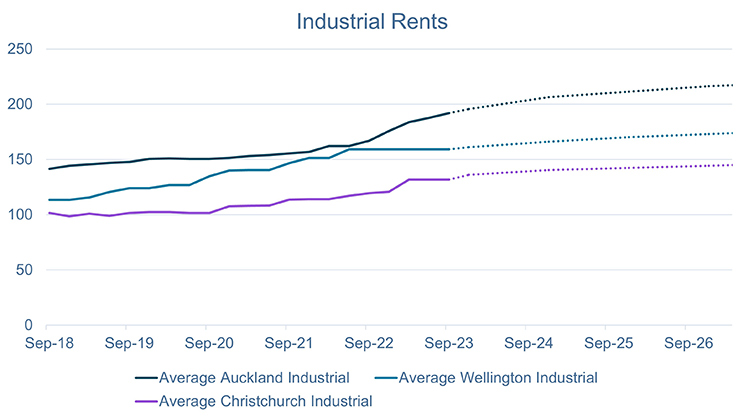

Industrial

The strength of the industrial markets across Auckland, Wellington, and Christchurch continues through the third quarter of 2023.

The Auckland South market still outperforms the rest of Auckland industrial, with net prime rents increasing by $4 per square metre, marking an increase of 15.3% year-on-year and sitting at a blended rate of $214 per square metre.

Auckland North-West saw net prime rents increase by $5 per square metre, a 16.7% year-on-year increase, to $210 per square metre.

The competitiveness of the industrial sector continues due to consistent occupier demand exceeding new available stock due to higher construction costs and softening yields. All of these factors point to the ongoing strength in the market for well-located, quality stock.

This trend is driving the development pipeline for industrial markets, despite continued upward pressure on construction costs. Over 570,000 square metres is expected in the Auckland market over the coming three years, including a 70,000 square metre Mainfreight warehouse in Penrose, and a 22,630 square metre warehouse for Fisher & Paykel in East Tāmaki.

In Wellington, around 34,000 square metres is in the industrial pipeline, including a custom-built facility for Tesla.

Most of the development in Christchurch is around the north and west of the CBD, in Rangiora, Rolleston, and Belfast.

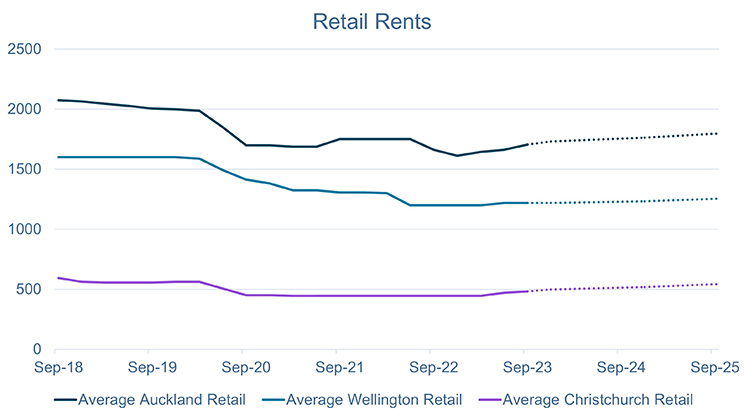

Retail

In the first half of 2023, we saw the trend of small-scale retailers moving away from expanding in physical stores to grow their businesses, with many moving to online platforms as a result of post-pandemic consumer behaviour. This trend has slowed, with strong demand in the third quarter of 2023 for strip retail opportunities in Auckland’s CBD and the Wellington and Christchurch retail markets. Notably, while net rents remained unchanged in the capital, retail vacancy fell 1.5% to sit at 6.7%. In Christchurch, where net rents have continued rising in the retail space through 2023 by 13.0% to date, CBD retail vacancy decreased by 1.2% to sit at just 3.1%.

Bulk retail has performed strongly since 2022. The new Mitre 10 MEGA outlet in Silverdale opened its doors in Q3. Located inside the Highgate Business Park, it is the group’s 85th nationwide store and has a footprint of over 11,000 square metres.

Significant retail developments in Auckland and Wellington are forecast to add over 5,000 square metres of retail space to the market, with several high-end developments in Auckland’s CBD featuring retail space within office buildings.

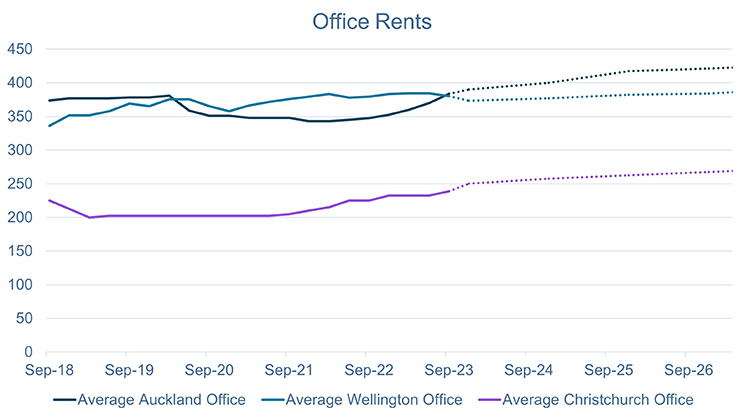

Office

Occupiers continue to seek properties that are better equipped to attract and retain the best talent, and this translates into prime and A-Grade offices for lease being sought-after. There has been heightened leasing activity in the third quarter of 2023 at the upper end of office rents across Auckland, Wellington, and Christchurch. This trend is driving the divergence between prime and secondary net rents in all three cities.

Net prime rents for Auckland’s CBD office market increased by $15 per square metre, marking a total increase through the first three quarters of 2023 of $33 per square metre. After the first increase since September 2021, net prime rents for the Auckland fringe office market remained the same at an average of $263 per square metre.

A similar increase in net prime rents for Wellington occurred in Q3, increasing by $15 per square metre, while secondary office net rents increased by $7. This divergence is expected to continue widening as demand for premium space in the capital remains strong. There was a notable completion in Wellington this quarter, 44 Bowen Campus, while the BNZ building at 1 Whitmore Street is expected to complete by the end of 2023.

The already tight office market in the Garden City continued through Q3 of 2023 with a reduction in prime office vacancy from 3.6% to 3.0%. The average net prime rents in Christchurch followed the national trend by increasing $8 per square metre. Net prime CBD rents are expected to increase by a further 3.3% before the end of 2023.

View the full reports: