Ongoing tenant demand for industrial property has kept vacancy rates at historically low levels, despite higher interest rates, a cooling economy, and increased development activity, Colliers reports

Although, sales activity volumes for industrial premises have slowed due to challenging economic and tougher financial conditions, industrial property’s strong fundamentals continue to underpin the sector’s safe-haven credentials which have seen the sector’s share of total commercial and industrial sales

increasing.

Strong demand holds vacancy at historic lows

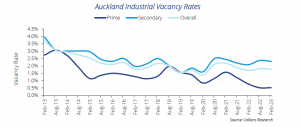

Auckland’s industrial vacancy rate was recorded at 1.9% by Colliers Research in its latest February 2023 survey, virtually unchanged from the August 2022 figure of 1.8%. Vacancy across the region’s major industrial precincts have been below 2.5% since February 2015. Conditions are tighter at the prime end of the market, with vacancy measured at a new record low of just 0.5%.

When viewing the results by area, vacancy declined in the region’s three largest industrial precincts over the six months to February. In East Tamaki, which has a total inventory of nearly 2,500,000 sq m, vacancy declined from 1.5% to 1.3%. Across the Onehunga/Penrose precinct, vacancy dropped from 2.7% in August to 2.0% in February.

Vacancy increased in Mount Wellington the fourth largest of the region’s precincts. Overall vacancy rose to 0.9% from 0.3% six months earlier. The increase has, however, been driven entirely by the secondary sector in which vacancy has reached 2.3%. By contrast, as at the date of survey, there were no prime grade leasing options. The extended period of tight market conditions and limited development opportunities within most established precincts has resulted in the emergence of new industrial zones on the periphery of the city. These zones are also witnessing strong demand and low vacancy rates.

In Westgate, over 16,000 sq m of workspace was added to the area’s inventory between August 2022 and February 2023, yet vacancy remained virtually unchanged at 0.6% in February. In Silverdale, vacancy declined to 2.5% from 3.3%, despite development adding 19,500 sq m of stock.

The conditions illustrated within the latest Auckland vacancy survey are reflective of the situation in many of the nation’s leading industrial areas. In Wellington Colliers’ vacancy survey conducted in November 2022 found vacancy throughout the region to have fallen to 1.3% down from 2.0% a year earlier. The 2022 figure is the lowest recorded since inception of the vacancy survey in 2011, except for 2019.

Development slows as constraints remain in play

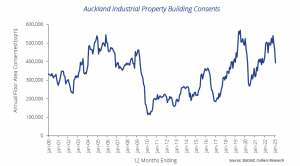

Construction activity recovered quickly following a sharp decline resulting from the onset of the COVID-19 pandemic. High levels of demand and accommodative economic conditions bolstered confidence within the development sector. Building consent issuance for the year ending November 2022 reached 574,187 sq m, almost at the record level of 569,682 sq m recorded for the 12-month period ending in July 2019.

While the results of vacancy surveys and upward pressure on rentals, which reached record levels in 2022, reflect the need for significant additions to stock, particularly at the prime end of the market, challenges faced by the development sector have intensified, leading to a slowdown in activity. The latest consents data released by StatsNZ shows the total floor area approved over the year to January 2023 to be 393,453 sq m, the first time the rolling total has fallen below 400,000 sq m since November 2021.

Once again, the trends evident in Auckland have parallels elsewhere in the country. In Wellington, the area approved for new construction in the year to February 2023 was 40,103 sq m, having peaked at 56,490 sq m in the 12 months ending September 2009. In Christchurch, whilst the decline has been milder the total fnew floor area approved has slipped from a peak of 254,200 sq m as of October 2022 to 244,171sq m in February.

The slowing of momentum reflects a combination of constraints impacting the development sector. A shortage of skilled workers and supply chain disruption has contributed to rapidly rising construction costs, which, according to StatsNZ’s capital goods price index, saw costs for industrial premises increase by a further 10.1% over 2022.

A shortage of appropriately zoned land for industrial expansion is another major constraint. Land shortages, particularly within established precincts, have kept prices elevated, with the average cost of industrial land across Auckland of $1,185 per sq m at the end of 2022, well above the approximately $805 per sq m recorded in December 2020.

Easing of some impediments will be welcome

Although the construction sector will face challenges in the remainder of 2023, the industry will welcome the easing of some of the industry’s major constraints. Building costs have shown evidence of passing their peak, due to a reduction in supply chain issues and a slowing of trade rate increases. Moreover, the government has taken steps to ease skills shortages by creating new pathways for overseas workers to obtain work visas, such as reopening the skilled migrant category residence visa, which had been suspended during New Zealand’s border closure, and implementing the Accredited Employer Work Visa system.

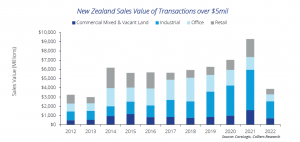

Industrial sector underpins sales activity Property investors have become more cautious about the market in recent months due to rapidly rising interest rates and forecasts of an economic recession. As a result, sales volumes have declined from the elevated levels seen in 2020 and 2021. The total value of commercial and industrial assets, with a minimum sales price of $5 million in 2021, was approximately $9.3 billion. Provisional figures for 2022 indicate that this figure fell to just under $3.9 billion.

Although sales volumes have decreased, the industrial sector’s contribution to total value has remained steady at just under 50%. The industrial sector’s share of total sales rose sharply in 2019 to 44% from 30% a year earlier, and the provisional share in 2022 is 48%. The increase in industrial sales relative to other sectors reflects the strong occupier fundamentals of industrial property, which have bolstered the sector’s safe-haven reputation.

Given the ongoing strength of occupier demand and the constraints that continue to affect the development sector, it is likely that industrial property will remain attractive to investors for an extended period.