JLL provides property insights into how the office, retail and industrial markets are faring within New Zealand’s biggest cities

Office

With workplaces shifting focus to building the office of the future to help attract and retain top talent, what markets are providing opportunities for investors?

With the battle to attract and retain the best talent in the workforce, the ‘flight to quality’ we have seen over the past two years is continuing. This is driving further divergence between prime and secondary office space for lease in cost per sqm as well as uptake of vacant property.

Employers are following their employees favouring higher quality workplace environments, and therefore see the investment in prime space as a key strategy in providing fit-for-purpose, flexible offices.

The evolving use of the office in this post-pandemic environment requires organisations to reflect on the best use of the workplace to encourage people back to the office and reduce ‘desk vacancy’.

Grade A office space in Auckland CBD has remained stable since 1H22, with vacancy at 6.6%. Secondary follows suit, remaining the same at 16.6%. As more occupiers move to prime offices in response to the shifting demands of the workforce, this divergence is expected to grow.

Prime CBD office vacancy decreased to under 10%, while grade and location across Auckland, Christchurch, and Wellington shows a widening gulf.

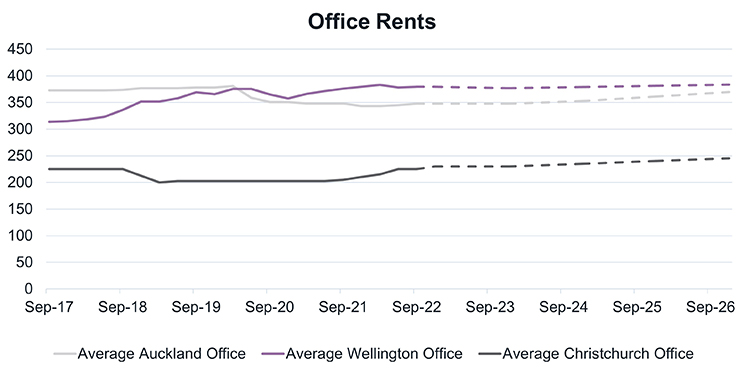

Vacancy rates in the Wellington market continue at record-lows, in turn driving up prime rents which are forecast to reach $638 per sqm in 2023. Government tenancies continue to be a strong driver for the office market in the capital. Soon-to-be-completed developments at 15 Customhouse Quay will add 3,600sqm of office space in the next few months.

Secondary office space in Christchurch showed increased vacancy from 6.0% to 8.0% primarily due to space arising on Victoria Street. Further out of the CBD, vacancies on Wairakei Road drove secondary suburban vacancies up to 24.4% (a difference of 13.9%). More than 4,000sqm of office developments are in the pipeline, much of that space pre-leased, with expected completions in 2023 and 2024.

Retail

While there are signs of recovery appearing, net rents in Auckland CBD decreased over the last quarter. Wellington and Christchurch markets are stable, but what factors should occupiers and investors look at heading into 2023?

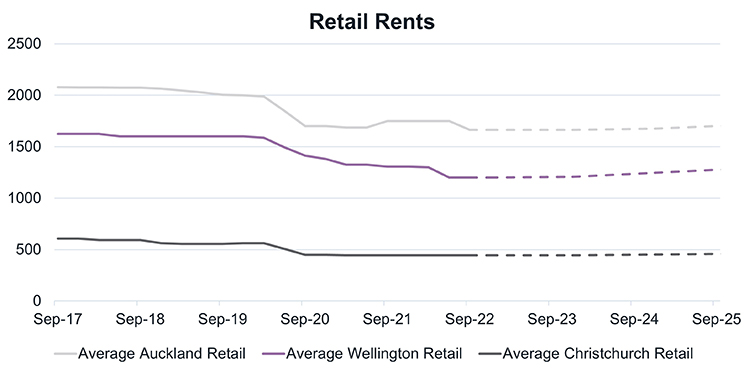

Following a whole year of unchanged prime average net rents, Auckland CBD saw a lowering of 6.8% ($175 per sqm) due to the slow rebuilding of city centre foot traffic following the lifting of pandemic restrictions.

There remains international interest from retailers in the Auckland CBD, however this interest is pushing into 2023 with some key brands intending to come to market as we experience higher CBD populations across Auckland, Wellington, and Christchurch.

In the Wellington retail property market (CBD and southern CBD), vacancies continued their positive (downward) trajectory, dipping below 10% to sit at 9.1% (a change of 4%). With more than $200 million in the Wellington CBD pipeline due to be completed in 2023, retail continues to be a small component of the developments.

Christchurch continues its stable rent outlook, with prime retail space remaining unchanged at $575 per sqm since the third quarter of 2020. Similarly, secondary retail rates have remained steady at $315 per sqm since the beginning of 2021.

Mixed-use developments that include notable retail space around Gloucester Street, Victoria Street, High Street, and Cashel Street highlight the strength of the Christchurch market and indicate to stable performance for the beginning of 2023.

Industrial

Stable demand for prime space is driving low vacancy rates even further. What factors will impact performance as we continue to operate in a high interest rate environment?

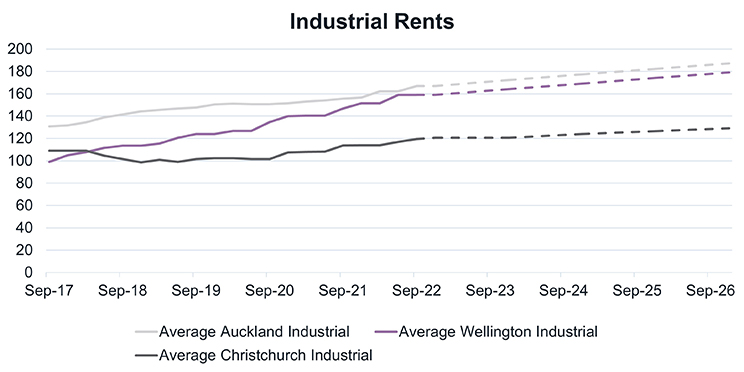

Stable occupancy rates and continued low vacancy are key factors driving rental growth in the logistics and industrial property market.

For the second quarter in a row, prime industrial net rents have increased in Christchurch (by 3.8%), with a similar trend seen in Auckland.

The most notable change was in south Auckland, where prime industrial rent increased by 5.6% ($10 per sqm), and secondary space increased by 3.5% ($5 per sqm).

Natural competitiveness in the sector due to occupier demand, limited new stock in the pipeline, and increasing yields will continue to drive the performance of industrial assets into 2023.

Vacancy rates for industrial assets on Auckland’s North Shore lowered to 0.7% in the first half of the year, highlighting the demand in this precinct.

A similar story is seen in the Wellington market where vacancy is below 2% (1.8%) largely due to local demand and a lack of available greenfield land for new developments.

Christchurch’s industrial pipeline is experiencing opposite conditions, with approximately 60,000sqm of industrial development due to be completed by the end of 2022, and a further 25,000sqm in the pipeline. These additions to the market drive the message that Christchurch is seen as an important investment market, performing consistently despite the rising interest rate environment.

Looking Ahead

- The significant uptick in attention to Environmental, Social, and Governance considerations across all markets remains front of mind for owners and occupiers alike. While there are no regulatory requirements for Green Star and NABERS ratings for commercial real estate currently, observing offshore trends in Australia, the UK, and Europe points to New Zealand adopting its own regulatory framework.

- We have unintentionally entered into a ‘price discovery’ phase as buyers and sellers work through the higher interest rates environment and its impact for yields.

- Occupiers are actively encouraging employees to return to their workplaces, using strategies such as social events and better collaborative environments and tools to reduce desk vacancies.

- Attracting and retaining tenants will continue to be driven by quality offerings across asset classes, underpinning the ‘flight to quality’ and resulting in the evolving rising rental narrative and widening divergence between prime and secondary assets. This is forecast to carry over into 2023.

JLL real estate market research is based on data from several reputable sources including on-the-ground insights from its own departments. First published November 2022.