JLL explores what is happening across New Zealand’s biggest cities in the office, retail and industrial and logistics markets

Office

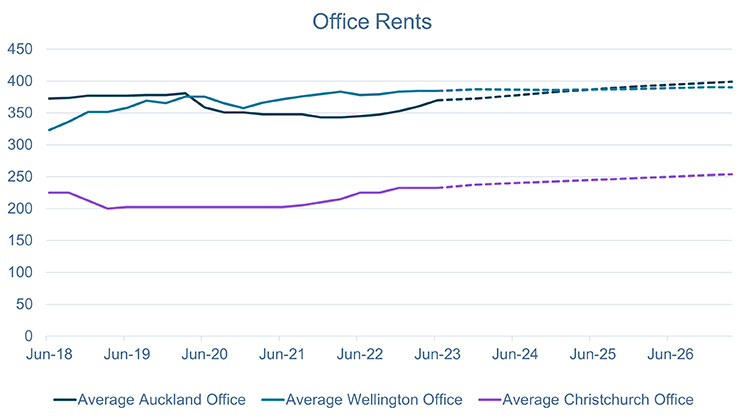

The gulf between prime and secondary office space for lease continues to widen as tenants and employers seek properties that are better equipped to attract and retain the best talent in the market.

Furthering this narrative, net prime rents in Auckland’s CBD office market increased by $8 per square metre in Q2 of 2023 – up a total of $18 per square metre through H1. Vacancies slightly increased in the Auckland CBD Core sector despite the desire from occupiers to take up better, more future-fit offices, however net rents are still forecast to climb in the coming years. In fact, over the next five years, prime office rent in Auckland’s CBD are expected to rise by 12.1%, while secondary office rent will only rise by 6.7%.

The Archives Building at 2-13 Aitken Street and the new home of the Ministry of Foreign Affairs at 61 Molesworth Street are among notable developments in Wellington’s office market, both pre-leased and due to be completed in 2026 and 2025 respectively. The MFAT office will add more than 24,000sqm of 6-star Green Star and 5-star NABERS office space to the market.

The already tight office market in the Garden City continued through Q2 of 2023 with a reduction in office vacancy from 3.5% to 2.1%. Over 5,000 square metres of office space was added to Christchurch’s market in the past quarter – a clear indicator of strong performance when combined with the lower vacancies in the city.

Average net rents and yields slightly softened across most markets.

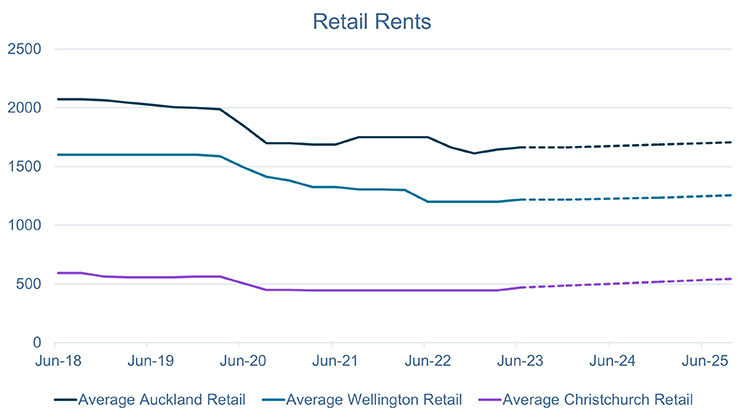

Retail

Following the shift to more online platforms due to the pandemic, many small-scale retailers have moved away from expanding in physical spaces to grow their businesses. On the other end of the scale, luxury retailers are taking up prime sites over 200 square metres, particularly in the CBDs. As a result, the upper end of luxury spaces in Auckland has been pushing over $5,500 per square metre, while in the suburbs, it’s edging closer to $1,000 per square metre.

In the capital, following the decrease in average net prime rents at the beginning of 2022, performance has remained steady. Signalling the performance of the sector in Wellington, vacancy in the city significantly decreased in Q2 2023, down 1.5% to 6.7%, driven by a rise in leasing activity on Willis Street and Cuba Street.

Bulk retail continues to build on its strong performance from 2022, where it finished with rent growth in Q4 up 7.69%. Minimal space is in the pipeline in Auckland CBD aside from some smaller retail components in mixed-use developments, due to complete in 2023.

In the Garden City, average net prime CBD rents have increased significantly through H1 of 2023, up $75 per square metre in the last quarter to stand at $625 per square metre. This performance is expected to continue, driving prime rents in the CBD to $845 per square metre by 2027. The development pipeline in Christchurch remains strong following the addition of 5,500 square metres of retail space in Q2 2023, with over 3,500 square metres due to be completed by 2024.

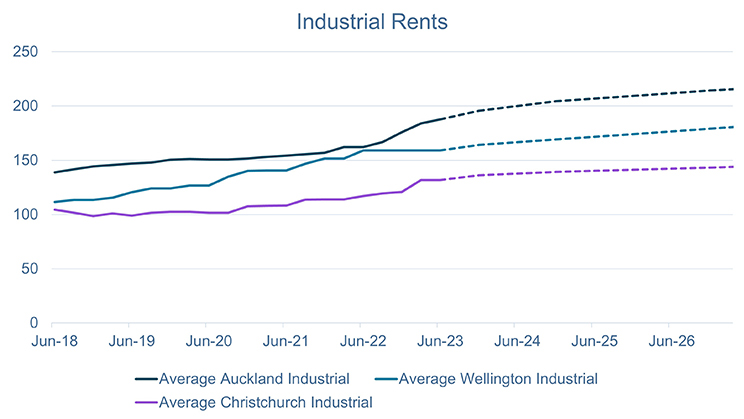

Industrial & Logistics

There has been a slight shift in the recent trends in the industrial sector across Auckland, Wellington, and Christchurch, with vacancies slightly up and rents largely unchanged. However, in Auckland City industrial, rents increased by 4.3% to have risen 17.9% over the year to Q2 2023. Secondary rents for the same sector increased 15.0% over the same time period.

In Wellington, rents remained unchanged for the fifth consecutive quarter, however vacancies increased by 0.3% (to 1.8%) for the second quarter in a row. The competitiveness of the industrial sector continues due to consistent occupier demand exceeding new available stock due to higher construction costs and softening yields. All of these factors point to the ongoing strength in the market for well-located, quality stock.

That is driving the development pipeline in the industrial sector as well, despite rising construction costs. Over 370,000 square metres is due to be delivered in the key southern industrial corridor, on top of the over 200,000 square metres that has been added to the market already in H1 2023. The pipeline in Christchurch is also strong, and more than 60,000 square metres was added in Q2 2023. By contrast, Wellington’s pipeline is limited, with only two significant developments underway that will add around 17,500sqm. The consistently tight market in the capital will enhance demand for new spaces further.