While overall sales slightly declined in August, REINZ’s latest numbers show notable increases in activity in several regions, and year-on-year listing numbers continue to rise

REINZ Chief Executive Jen Baird says August provided a sense of confidence and positivity to the property market.

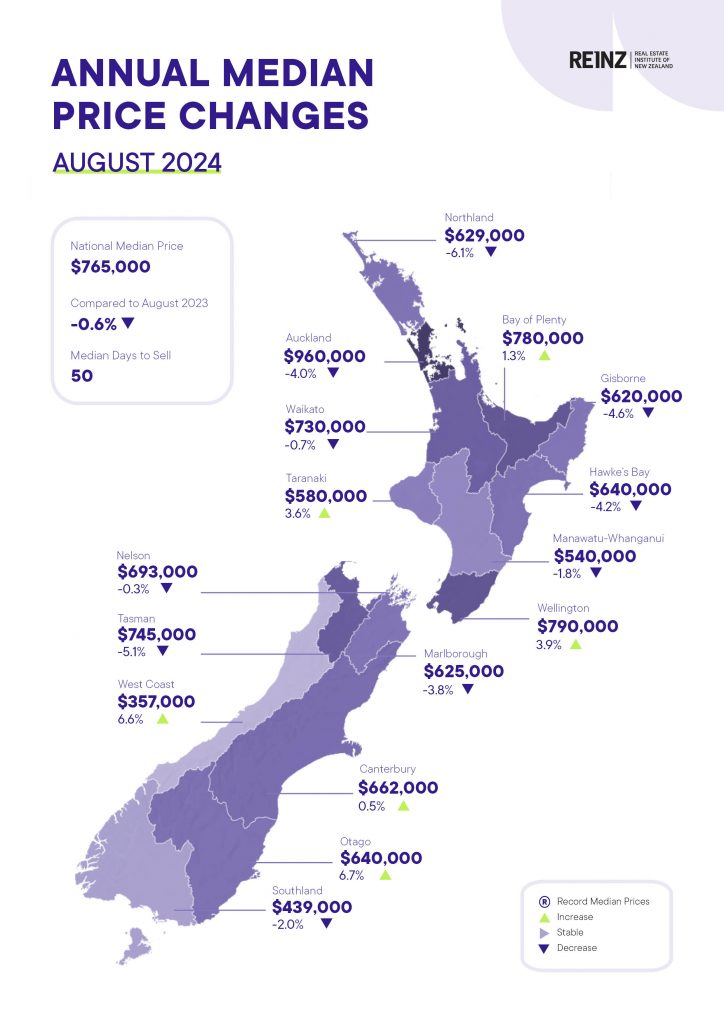

“August data shows a level of stability in the market. Despite a marginal 0.6% (or $5,000) decrease in national median prices year-on-year, we’re seeing prices hold steady with a 1.3% increase month-on-month,” said Baird.

Compared to August 2023, the total number of properties sold nationally decreased by 0.7% (just 40 properties), from 5,725 to 5,685, and decreased by 5.1% month-on-month, from 5,992 to 5,685. In the regions, eight regions saw an increase in sales in August 2024, and the most significant increases were in Northland (+22.7%), Hawke’s Bay (+21.6%) and Bay of Plenty (+16.2%). Compared to July 2024, five regions saw an increase in sales volume.

The national median price decreased by 0.6% year-on-year, from $770,000 to $765,000, and increased by 1.3% month-on-month. For New Zealand, excluding Auckland, the median price increased 1.6% year-on-year from $670,000 to $681,000. Month-on-month, the median price increased by 1.8%.

Six of the sixteen regions had a median price increase year-on-year, with Otago leading the way with a 6.7% increase to $640,000, followed closely by the West Coast with a 6.6% increase to $357,000. Eight regions increased month-on-month, with the most notable changes observed in Marlborough (+7.8% to $625,000) and Gisborne (+6.0% to $620,000).

Staying in the regions, thirteen of the fifteen have seen a rise in new listings year-on-year, with the most notable increases recorded in Gisborne (+69.2%), Marlborough (+40.8%) and Manawatu-Whanganui (+39.8%). Two regions saw a decrease in new listings year-on-year: Nelson (-18.1%) and Northland (-11.1%). Nationally, there was an 8.1% increase in new listings compared to August 2023.

“This month, we saw further signs of a change in market sentiment, with local agents reporting increased confidence in vendors and purchasers, the return of investors, and increased activity, particularly at open homes over the last two weeks of August. They attribute this change to the decline in interest rates. However, it would be an overstatement to say that we are at a turning point in the market – we merely have our indicators on. While there is a rise in optimism and confidence, we are hopeful that better times are still ahead,” adds Baird.

Compared to August 2023, the median days to sell increased by eight days, from 42 to 50 days nationally. For New Zealand, excluding Auckland, median days to sell increased by six days, from 43 to 49 year-on-year. Five regions had fewer days to sell in August 2024 than in August 2023. Northland had the highest median days to sell at 71 days, an increase of 10 days year-on-year.

“We continue to see an increase in the average number of properties listed. Although the inventory is down slightly compared to last month, the volume of properties for sale continues to provide a lot of choice for buyers,” adds Baird.

There were 656 auctions nationally in August 2024 (11.5% of all sales), compared to 799 (10.9% of all sales) in August 2023. The Auckland region called 335 auctions in August 2024 (18.6% of all sales), compared to 492 auctions or 25.5% of all sales in August 2023.

“There is an expectation that rates will fall further towards the end of this year, providing the much-needed relief to property owners and those in the position to buy, which may increase sales volumes nationwide,” comments Baird.

The HPI for New Zealand stood at 3,563 in August 2024, a 0.8% decrease from August 2023. There was no change compared to July 2024. The average annual growth in the New Zealand HPI over the past five years has been 5.0% per annum, and it is currently 16.7% below the market peak reached in 2021. Southland is the top-ranked region in August, with a +3.0% increase year-on-year.

Median Prices

- Six of 16 regions had year-on-year price increases with Otago leading the way with a 6.7% increase.

- With Auckland, just one of seven TA’s had positive year-on-year median price movements – Rodney District at +2.2%.

- With Wellington, five of eight TAs had positive year-on-year median price movements with South Wairarapa District leading the way with +19.0%, followed by Upper Hutt City at +16.0%.

- There were no regional median price records this month.

- There were no record median prices at the TA level this month.

Sales counts

- Hawke’s Bay had its highest sales count since December 2021.

- Northland had its highest sales count since November 2023.

- In terms of the month of August, August 2024 had the highest Sales Count in

o NZ Excl. Auckland, Bay of Plenty, Hawkes Bay, Northland, Tasman, Waikato and Wellington since 2020 - In terms of the month of August, August 2024 had the lowest Sales Count in West Coast since 2014

Median Days to Sell

- Marlborough had its highest median Days to Sell since April 2023.

- Wellington had its highest median Days to Sell since July 2023.

- In terms of the month of August, August 2024 had the highest median Days to Sell in

o Auckland since 2001

o New Zealand since 2008

o Marlborough and Waikato since 2014

o Canterbury since 2018

House Price Index (HPI)

- Southland is the top-ranked HPI year-on-year movement this month. Otago is second and Nelson/Marlborough/Tasman/West Coast is third.

- Regarding the 3 months ending HPI movement, Otago ranks first, Canterbury second and Southland third.

Inventory

- All 15 regions have had an increase in inventory in August 2024 compared to one year prior.

- Taranaki has had 34 consecutive months of year-on-year increases in inventory.

- Northland has had 29 consecutive months where their inventory has been at least 15% higher than the same month the year before.

Listings

- Thirteen of 15 regions had a year-on-year increase in listings in August 2024 compared to one year prior.

- Bay of Plenty and Otago have had 7 consecutive months where their listings have been at least 15% higher than the same month the year before.

- Hawke’s Bay has had 8 consecutive months where their listings have been at least 15% higher than the same month the year before.

Auctions

- Nationally, there were 656 auctions in August 2024, 11.5% of all sales, compared to 799 auctions or 10.9% of all sales in August 2023.

- Auckland 18.6% = 335 auctions vs 25.5% = 492 auctions in August 2023 (17.9% = 337 auctions in July 2024)

- Gisborne 33.3% = 12 auctions vs 28.6% = 10 auctions in August 2023 (18.6% = 8 auctions in July 2024)

- Canterbury 15.9% = 146 auctions vs 16.5% = 156 auctions in August 2023 (15.0% = 151 auctions in July 2024)