On a national level, house prices have stayed relatively stagnant over the past two months, but that doesn’t tell the whole story according to CoreLogic data for each city across the country

Home value growth in New Zealand has completely petered out in the past two months, with values dipping by 0.2% in May, after a minor 0.1% fall in April.

CoreLogic’s House Price Index now shows an average property value across NZ of $931,438, up by 1.0% from a year ago, but still roughly 11% below the peak.

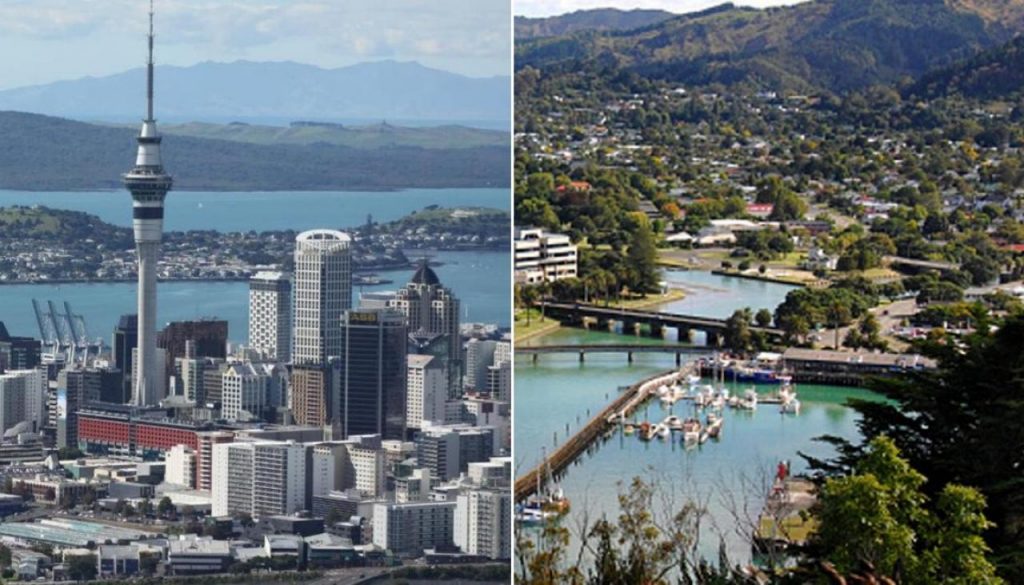

Below the recent stagnation at the national level, the main centres are showing multi-speed conditions. Auckland dropped a notable 0.8% in May (after a 0.6% fall in April), while Wellington saw a 0.6% fall, and Tauranga dipped 0.5%. By contrast, Christchurch rose 0.5%, and Hamilton and Dunedin both saw gains of 0.8% over the month.

CoreLogic NZ Chief Property Economist, Kelvin Davidson, notes that although the national declines over April and May have been very small, the shift in the market is clear to see.

“In the past few weeks we’ve seen a raft of regulatory changes, including the abrupt scrapping of first home grants, the near-term easing of the LVR rules and the introduction of debt-to-income caps. But with mortgage rates tipped to remain high for a while yet, it’s no surprise the market has lost a bit of the momentum we had been seeing through the early part of this year. Forthcoming tax relief for households is unlikely to change that,” Mr Davidson said.

“An important factor still in play is the high stock of listings on the market, and the associated shift in bargaining power towards buyers, which is subduing prices. We also estimate that the shortening of the Brightline Test from 1st July could see as many as 50,000 or so properties benefit to some degree from reduced risk of having to pay capital gains tax, which could see some more listings coming to market. Of course, only a portion of those properties will actually be put up for sale.

“On another note, borrowers who have faced higher interest rates as their previous mortgage deals come to an end have coped pretty well with tight monetary policy thus far, thanks largely to the strong labour market. Looking ahead, a little less job security could see housing activity and prices remain fairly subdued,” he added.

CoreLogic House Price Index

National and Main Centres

Auckland

Auckland has been at the forefront of the recent slowdown in property values across the country, and Waitakere was the only sub-market to avoid falls in May. The remaining markets saw declines ranging from 0.4% in Franklin to more than 1% in both North Shore and Manukau.

Over the three months to May, only Rodney saw growth in property values (1.5%), with the rest of Auckland down by at least 0.6%, and as much as 2.6%.

“There’s always been a perception that Auckland leads the rest of the country in terms of property market performance, and although the evidence shows that isn’t always the case, it’s certainly still pretty striking that our largest city is now seeing renewed weakness in prices,” Mr Davidson said.

“With listings up, buyers now have the bargaining power, and it’ll be interesting to see if this pattern spills over more significantly into other markets in the next few months.”

Wellington

After a slightly more robust result for April, Wellington’s property market slid back again in May, with Kapiti Coast the only area to record a meaningful gain (1.8%). Meanwhile, Porirua dipped 0.2%, and both Upper Hutt and Wellington City saw values fall in May by about 1%.

“Values across Wellington’s wider housing market remain 15-20% below their peak, but this doesn’t mean affordability has magically been restored to normal. With property values still quite high and mortgage rates elevated too, buyers are still facing challenges. That seems to be showing up in the variability of values from month-to-month, and within the various sub-markets,” Mr Davidson said.

Regional House Price Index results

Outside the main centres, the housing market is also a mixed bag. For example, Whanganui, Rotorua, and Queenstown all grew by at least 1% in May, but there were falls in values in areas such as Invercargill and Hastings, while Nelson was down by a more notable 1.0%.

Mr Davidson said high mortgage rates present challenges for all markets, whether they’re large or small.

“Many provincial parts of NZ are also dealing with some migration issues, such as younger people heading overseas. That could well be taking a bit of steam out of the property market in these areas.”

Other Main Urban Areas

Property market outlook

Looking ahead, Mr Davidson said the rest of 2024 could remain fairly subdued for the housing market, both in terms of sales volumes and property values.

“Affordability remains stretched and significant falls in mortgage rates probably remain a story for next year not this, especially if there’s risk the upcoming tax cuts do prove to be slightly inflationary.

“The removal of first home grants is unlikely to have a lasting or significant impact on new buyer demand, and the caps on debt-to-income ratios won’t bite straightaway either.

“But even so, our expectation that 2024 will only really see the housing market ticking along remains firmly on track, with activity and prices set to remain variable from month-to-month and across regions,” Mr Davidson concluded.