Record-low vacancy rates in the country’s leading industrial precincts have led to significant rental growth and a surge in development, but higher interest rates, inflationary pressures, and a cooling economy pose some potential headwinds to the sector, Colliers reports

Historically low vacancy rates

The latest industrial vacancy survey by Colliers Research in Auckland confirms the sector’s robust occupier fundamentals. As of August 2023, the overall vacancy rate in the region was 1.8%, the same as the previous year.

The prime sector of the market reported even tighter conditions, with a vacancy rate of just 0.7%. Auckland has maintained a vacancy rate of less than 2.5% since the first half of 2015. Similar conditions can be observed in Wellington, with a vacancy rate of 1.3% in November 2022, the second lowest since the survey’s inception in 2011. In Christchurch, although no vacancy survey is conducted, market estimates suggest a vacancy rate of approximately 1%, trending downward over the past few years from a previous average of 4% to 5%.

Development Responds, Land Shortages Grow

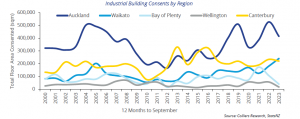

The prolonged period of high demand and low vacancy rates has prompted a response from the development sector, with building consent issuance data from Statistics New Zealand showing approval for an additional 1,188,200 sqm of industrial premises in the year to September 2023.

While this figure is lower than in September 2022, it remains above historical averages. Most regions have experienced increased development activity over the past four years, with Auckland leading the way, having consented 414,440 sqm of new industrial floorspace in the 12 months leading up to September 2023.

The Waikato region has witnessed a significant increase in construction activity, driven by the development of large-scale projects such as the Ruakura Superhub. Consent issuance over the 12 months leading up to September 2023 signals a continuation of this increased development activity, with just under 240,000 sqm of construction approved, accounting for 20% of the national total, well exceeding the region’s long-term average (2000 – 2023) of 11.3% However, the surge in construction activity has exacerbated land shortages, particularly in Auckland, where the shortage of greenfield development land, especially within established precincts, has constrained development and driven up land values Values increased rapidly over 2021 and 2022 to reach an average of 1 160 per sqm late last year subsequently values appear to have stabilised albeit that there have been limited sales in recent months In Christchurch, the extended period of elevated development activity has led to a shortage of land within precincts that had previously maintained a balance of supply and demand Average land values in Hornby/Islington have risen from 350 per sqm in late 2021 to 450 per sqm, while Rolleston has seen values increase from 250 per sqm in late 2021 to 280 per sqm.

Escalating Rental Rates

Tight market conditions have fuelled rental growth, with average prime grade warehouse face rents in Auckland increasing by approximately 33 over the two years leading to September 2023 Christchurch has seen a similar level of growth, with prime grade warehouse rents increasing by just over 26 to reach 134 per sqm Tauranga has experienced a 22 increase in average prime warehouse rents While rental growth has been more moderate in Waikato and Wellington, both regions have seen above average levels of growth over the last two years, with Waikato registering a 16 6 rise and Wellington a 12 5 increase.

Impact of Higher Interest Rates

The rapid increase in interest rates and concerns about a cooling economy have led to a more cautious approach from investors over the past 18 months Sales activity has slowed from peak levels experienced in late 2020 to mid 2022 when interest rates were at record lows Provisional figures for industrial sector sales in the 12 months to June 2023 indicate a total of just over 2 6 billion, with the potential for future data releases to increase this figure However, it is likely to be the lowest annual figure since 2015 Syndicators and REITs, which were previously major players in the market, have withdrawn, leaving owner occupiers and private investors as key participants.

Industrial Sector’s Continuing Significance

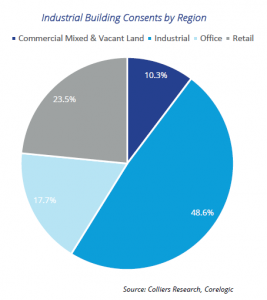

Despite the softening in sales volumes, the industrial sector remains a cornerstone of commercial and industrial sales activity, comprising just over 45 5 of total sales by value in the year to June 2023 according to CoreLogic figures In comparison, the retail and office sectors contributed 23 5 and 17 7 respectively.

Short Term Challenges and Long Term Prospects

Recent data releases suggest a softening of industrial market conditions New Zealand’s Performance of

Manufacturing Index ( has indicated contraction for seven consecutive months Inflation and concerns about rising living costs have led consumers to reduce discretionary spending, while unemployment has started to increase from historically low levels This shift is expected to lead to a decrease in occupier demand, potentially easing vacancy rates and slowing construction activity However, short term supports remain in place, while longer term demand drivers remain positive A net migration gain of 110 000 people recorded by Stats NZ in the year to August is underpinning demand for goods and services Additionally, there is potential for further growth in the short to medium term, as online retail activity in New Zealand, while increasing, still lags behind other major global markets Further occupier demand may also arise from the reshoring of manufacturing, driven by concerns about global supply chains arising from the experience gained during the COVID 19 pandemic and exacerbated by current heightened geopolitical tensions.