The decline in residential sales activity is being played out in the neighbouring lifestyle property markets across much of New Zealand, with sales volumes falling from the previous highs of 2021 and 2022, REINZ Rural Spokesman Shane O’Brien says

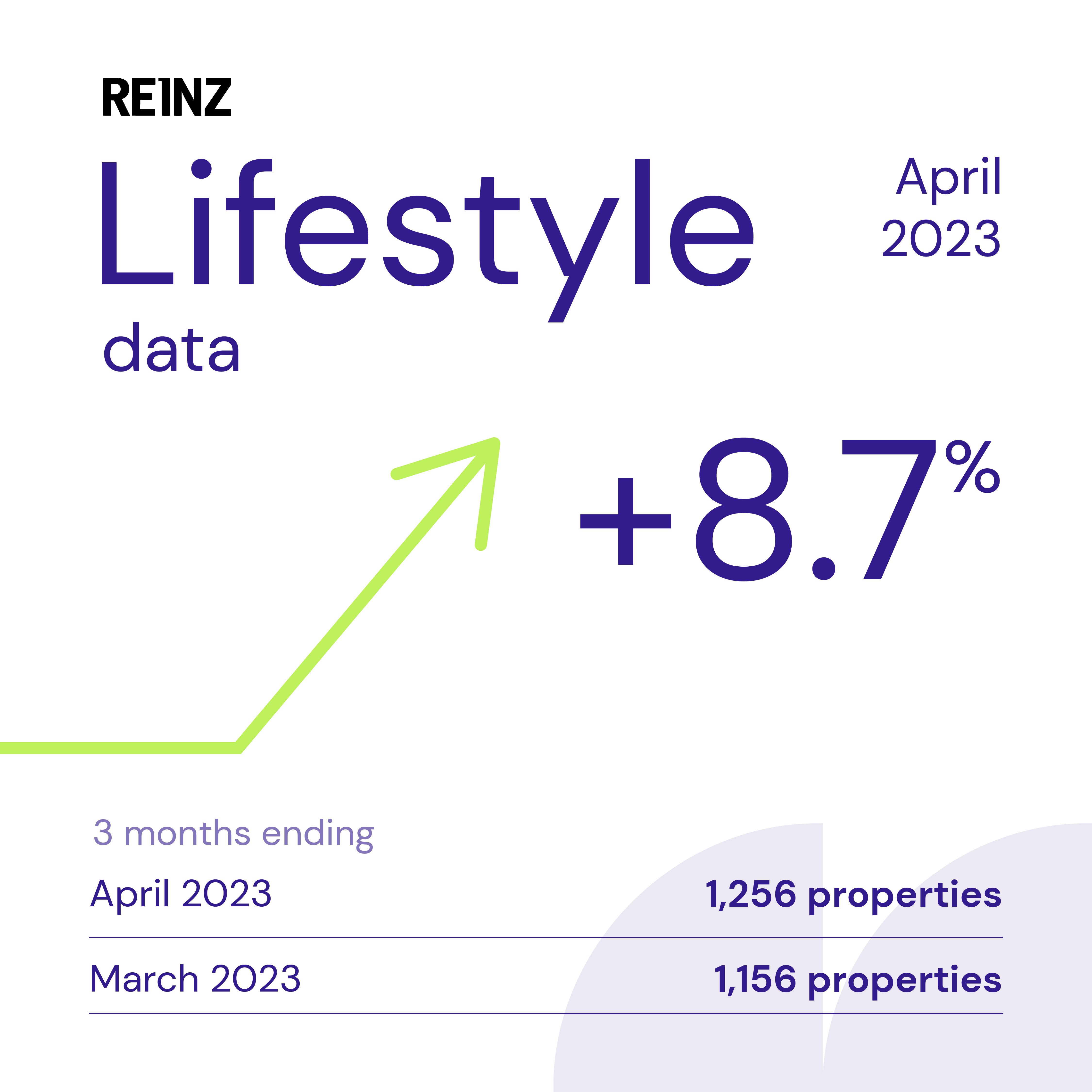

Data released by the Real Estate Institute of New Zealand (REINZ) shows there were 100 more lifestyle property sales (8.7%) for the three months ended April 2023 than for the three months ended March 2023.

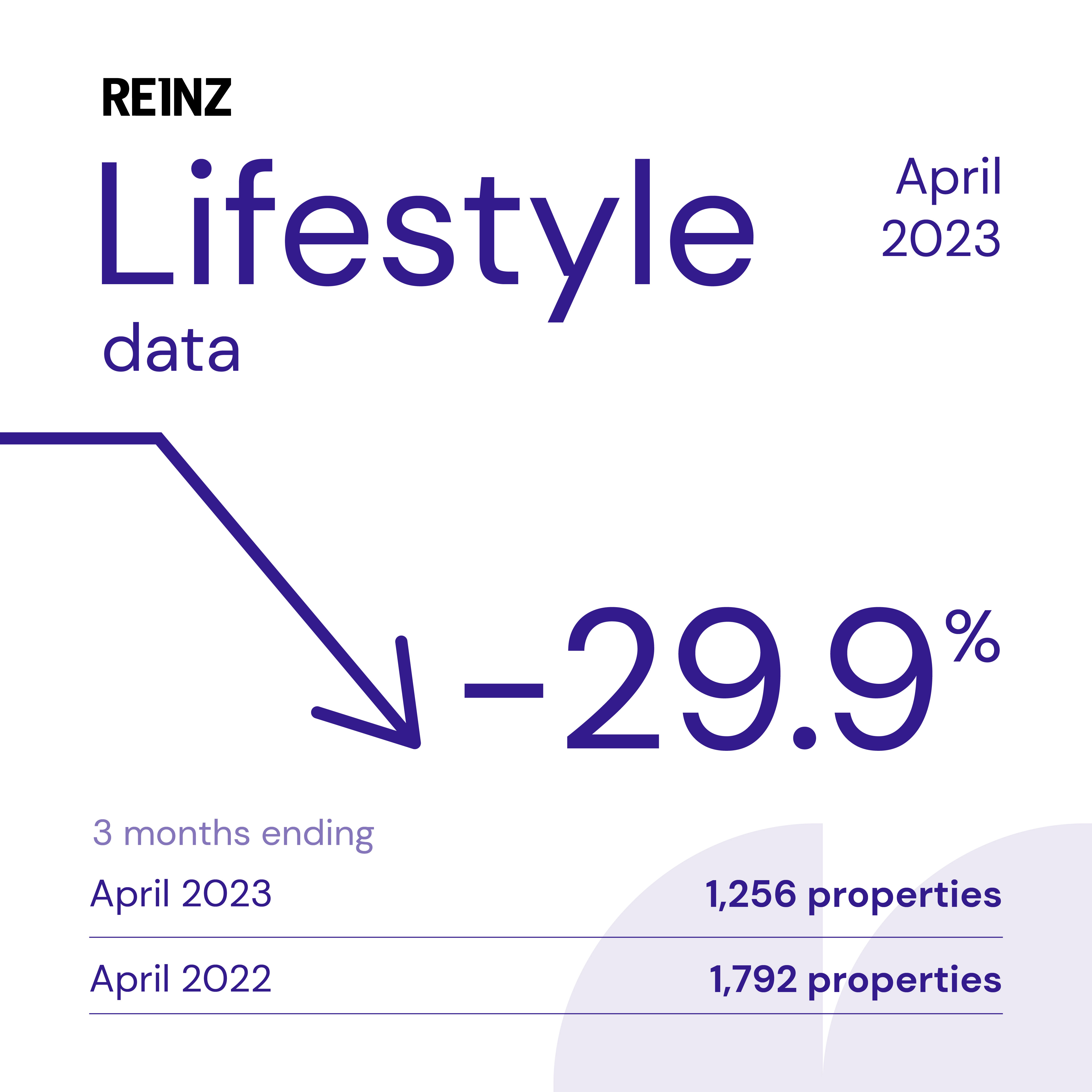

Overall, there were 1,256 lifestyle property sales in the three months ended April 2023, compared to 1,792 lifestyle property sales for the three months ended April 2022 (-29.9%), and 1,156 lifestyle property sales for the three months ended March 2023.

The first four months of 2022 have showed a steady decline in the number of both bareland and established lifestyle properties as markets reset following the increase in interest rates and wider economic conditions affecting many potential buyers.

Agents continue to report good numbers at open homes and enquiry on listings, however many buyers are adopting a wait and see approach against interest rates and if they have peaked and watching to see how the election plays out later this year. This general uncertainty is impacting on most market sectors including the commercial, rural and lifestyle property market.

5,830 lifestyle properties were sold in the year to April 2023, -2,724 (-31.8%) less than those sold in April 2022. The value of lifestyle properties sold was $6.89 billion for the year to April 2023.

The median price for all lifestyle properties sold in the three months to April 2023 was $975,000 and was $-102,000 higher compared to the three months ended April 2022 (-9.5%).

The median price for Bare land Lifestyle properties sold in the three months to April 2023 was $390,000 and was $-110,000 higher compared to the three months ended April 2022 (-22.0%). The median price for Farmlet Lifestyle properties sold in the three months to April 2023 was $1,112,500 and was $-167,500 higher compared to the three months ended April 2022 (-13.1%).

Recent policy announcements around the subdivision of productive land have started to impact the flow of bareland onto the market with reduced listings and corresponding falls in sale numbers across New Zealand.

Many South Island agents are continuing to report steady enquiry from Auckland buyers looking at making a lifestyle change particularly into the Canterbury and Central Otago markets.

Recent weather events in the traditional popular areas of Hawkes Bay and regional Auckland has impacted sales activity in these popular areas but this is expected to change in the later part of the year as the traditional Spring markets develop.

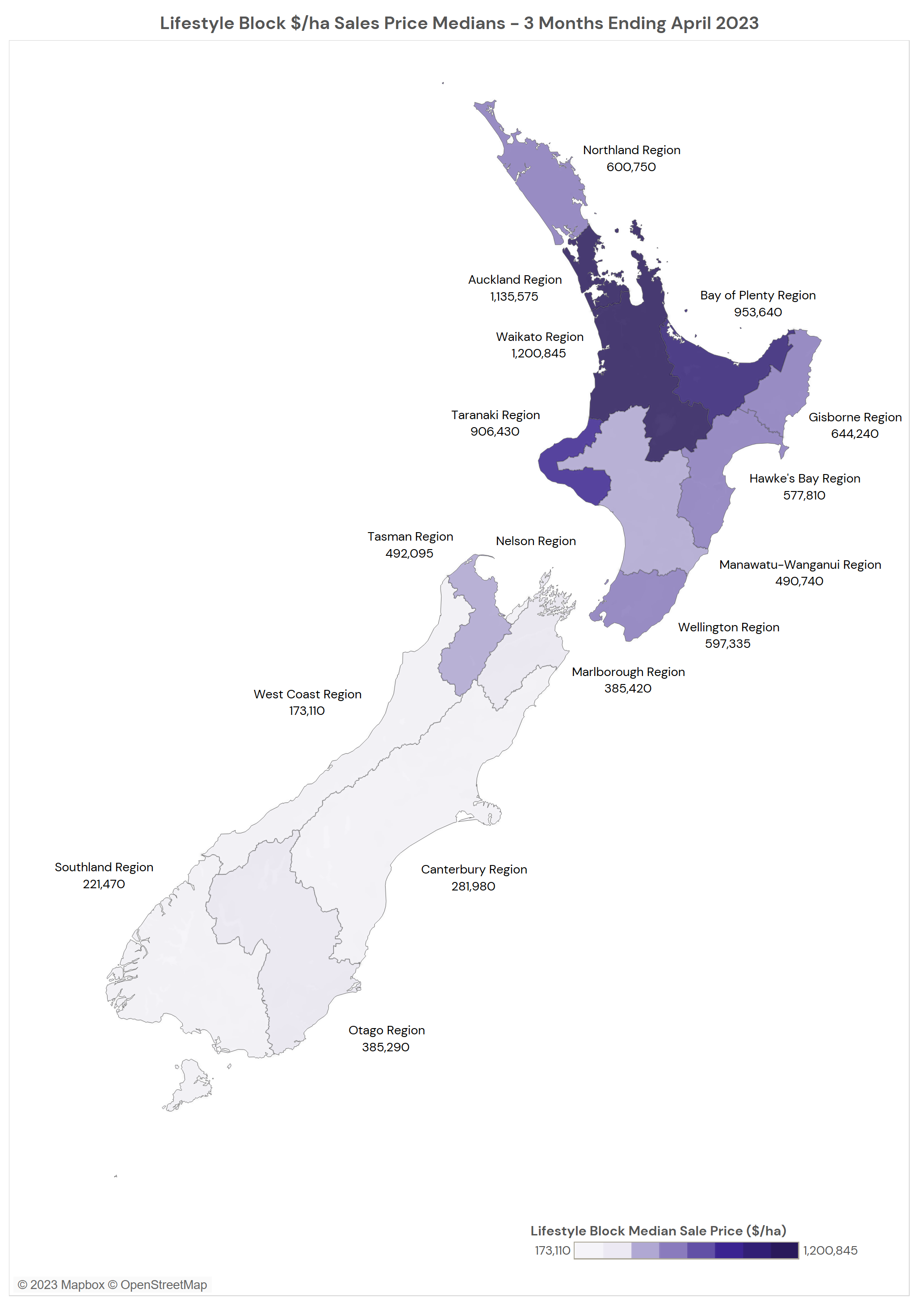

One region recorded an increase in sales compared to April 2022, with Manawatu-Wanganui (+2 sales) observing the biggest increase. Northland ( -110 sales) and Auckland ( -96 sales) recorded the biggest decreases in sales in the three months to April 2023 compared to the three months to April 2022. Compared to the three months to March 2023, 9 regions recorded an increase in sales.

Four regions saw the median price of lifestyle blocks increase between the three months ending April 2022 and the three months ending April 2023. The most notable examples were in Gisborne/Hawkes Bay (+17.6%) and Taranaki (+8.5%) with the biggest decreases being in Bay of Plenty ( -22.2%) and Wellington ( -19.9%).

The median number of days to sell for lifestyle properties was 24 days more in the three months to April 2023 than in the three months to April 2022, sitting at 67 days. Auckland and Canterbury (56 days) recorded the shortest number of days to sell in April 2023. Gisborne/Hawkes Bay and Otago (87 days) recorded the longest number of days to sell.