In its Vertical Vacancy Review for Q1 2023, JLL explores the trends among occupiers and forecasts in rental growth and sustainability requirements in the CBD office markets across Auckland, Wellington, and Christchurch

Throughout 2023, we are likely to see a further realignment of yield levels as investors adapt to the reset of funding costs, with an ongoing preference for prime assets over those with a high proportion of vacancy, higher risk occupiers, low seismic rating (especially in Wellington), or with larger capital investment requirements.

We forecast rental growth will continue for quality properties that have good tenants and covenants across all cities. Vacancy in these properties is expected to decrease as well, continuing the trend of divergence between prime and secondary grades.

Occupiers are continuing to work with their employees to collaborate on the ‘new normal’, and as a result, wellbeing is front of mind for those seeking appropriate, flexible working environments. In addition, with the employment market expecting to remain constrained, corporates will look to provide quality workplaces to attract and retain top people.

The importance of embodied carbon in existing corporate real estate will remain topical, as the growing trend to demolish and rebuild may not be the most sustainable choice for the environment in development project.

In addition to the social aspect of ESG (environmental, social and governance), stakeholder conversations are becoming more prevalent in the boardrooms, and local regulators are implementing environmental guidelines for building standards such as Green Star and NABERS (National Australian Built Environment Ratings System).

Cities at a glance

- Auckland – Vacancy in both premium and A-grade buildings continues to decrease, with vacancy decreasing across both Core CBD and Wynyard Quarter.

- Wellington – Significant activity in the capital sees four developments completed, another two undergoing seismic strengthening, and a further four under construction.

- Christchurch – The Garden City has experienced very few changes since the latter half of last year and remains stable with increased investor interest in this region, with one new prime CBD office due to be completed in Q3 2023.

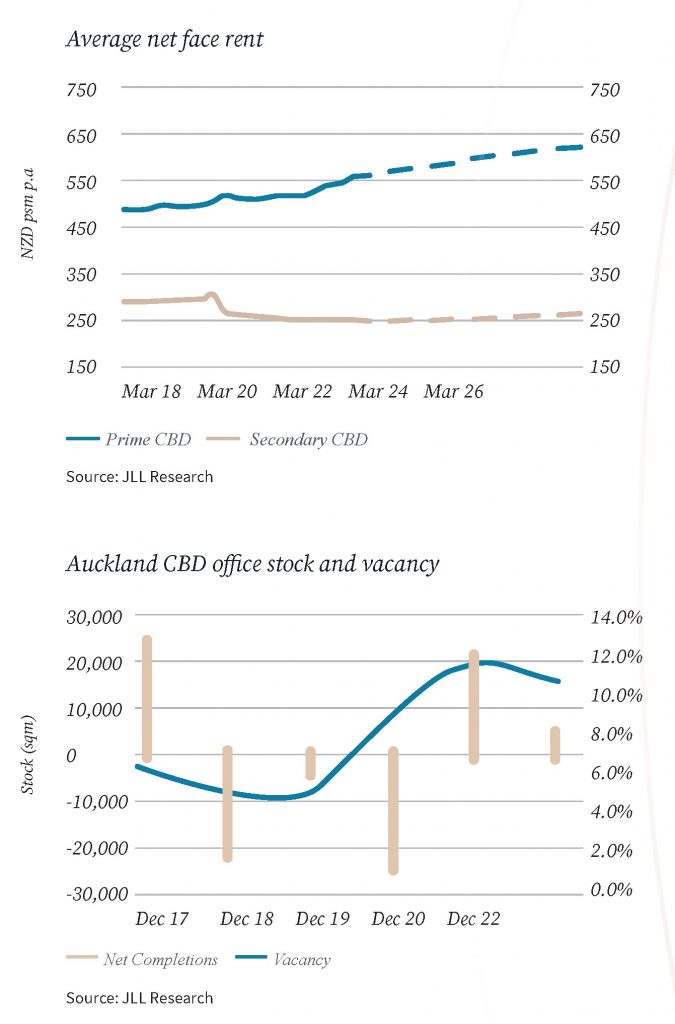

Auckland CBD

- Since JLL’s 3Q22 Vertical Vacancy Review, prime (premium

and A-grade) vacancies within Auckland’s CBD decreased

by 166 bps to 8.1% (from 9.7%). This represents an uptake

of an additional ~9,200sqm of space. Importantly, 10 out

of the 26 buildings in the precinct have 0% vacancy. - The vacancy trend for this period has been positive for

the five premium towers showing a decrease of 307 bps,

from 5.9% to 2.8%, illustrating an uptake of an additional

4,888sqm of space. This supports the current sentiment

of increasing demand for high quality office space,

especially assets located near the waterfront. - Vacancy in A-grade buildings also decreased, down 113

bps to 11.0% (from 12.1%), an uptake of 5,173sqm of

space. This was mostly made up of floors leased at 41

Shortland Street and 23 Customs Street East. - Average net prime rents increased by $10psm during

1Q23, from $548psm to $558psm. The upper end of net

rents for premium buildings, the highest recorded rent for

Auckland office buildings, now stands at over $850psm. - Incentives for prime properties are currently at 14.6%,

equivalent to ~1.75 months rent-free. These are expected

to decrease to 10.4% (~1.25 months rent-free) by 2024,

given occupier demand for new prime space. - There are three office buildings currently under

construction in the CBD, which are expected to add

53,000sqm by 2025. When completed, we forecast an

increase in vacancies in properties on the border of A

grade and upper end of B grade assets, as more and more

organisations compete to secure prime offices.

Auckland – Wynyard Quarter

- Prime vacancy within Auckland’s Wynyard Quarter

decreased by 97 bps to 3.1% (from 4.1%), representing an

uptake of 2,465sqm of space since our last review in the

second half of 2022. - Buildings that experienced a large decrease in vacancy

included 22 Viaduct Harbour Avenue and 34 Sale Street,

while 151 Victoria Street experienced a slight increase in

vacancy. - Significant moves include Ricoh taking up a full floor at

34 Sale Street, and Visa moving into 22 Viaduct Harbour

Avenue to take up ~3,500sqm of office space. - This quarter saw the decision by Auckland Council to

make a few floors available for sublease at 20 Viaduct

Harbour Avenue and at 167-191 Victoria Street West.

However these changes were offset by some spaces at 46

Sale Street and 109 Fanshawe Street being leased. In total,

sublease space decreased from 11,122sqm to 10,683sqm. - Precinct’s Wynyard Quarter Innovation Project includes

three buildings – 117 Pakenham Street (8,700sqm), 124

Halsey Street (9,700sqm), and 126 Halsey Street (The

Flowers Building). Beca will lease 14,000sqm across five

floors within this development, expected to complete by

2025. Floorplates will comprise around 2,900sqm each.

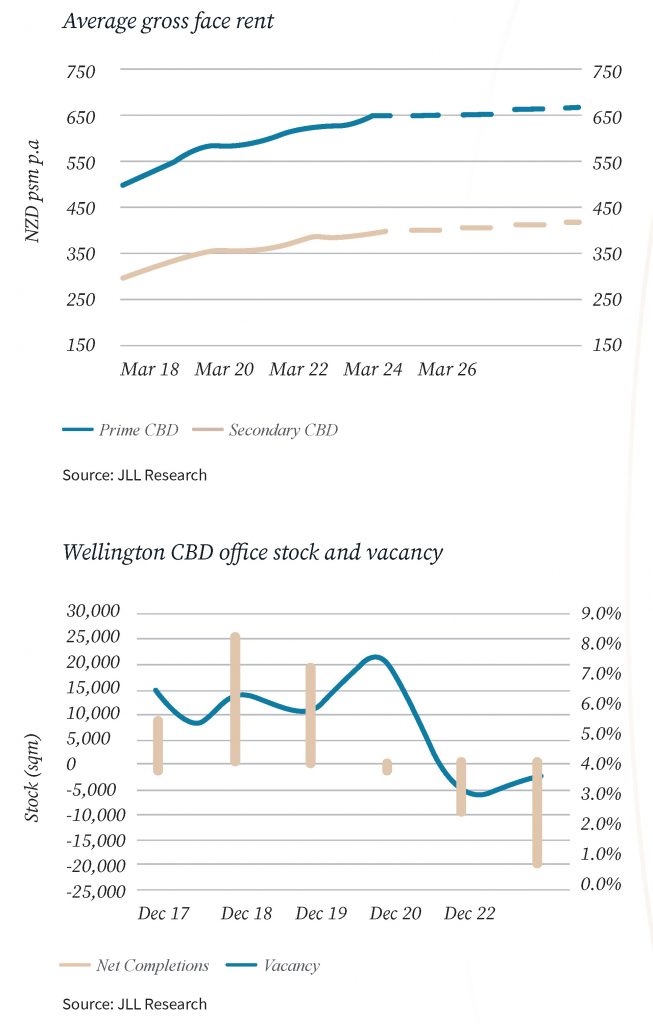

Wellington

- Wellington prime office vacancy increased by 474 bps,

from 2.6% to 7.3%, representing 18,114sqm of additional

space available. The majority of this vacancy increase is

in two properties, being the Asteron Centre and Maritime

Tower. We are aware of deals underway which will have a

positive impact on vacancies. - Average gross rents for prime buildings increased by

$5psm during 1Q23, now at $640psm. This represents

a 2.8% year-on-year increase, expected to increase by a

further $5psm per annum over the coming years due to

the demand for seismically strengthened office space in

the capital’s CBD. - Rents for new builds are currently registering significant

increases – 3.8% quarter-on-quarter and 9.4% year-on-year.

They currently stand at $760psm and are expected to peak

in 2025 at ~$805psm, after which the increases are

expected to stabilise. - Despite the increase in overall vacancy, 19 out of the 25

buildings in Wellington were recorded at 0% vacancy.

This is mainly due to limited additions to supply in recent

years and ongoing government office requirements. - Developments underway include 2-12 Aitken Street (pre-leased

to Archives New Zealand), 61 Molesworth Street (pre-leased

to the Ministry of Foreign Affairs and Trade), 48 Mulgrave

Street, and 161 Victoria Street (two of three floors have been

pre-leased to Meridian Energy and Tonkin & Taylor). - Sublease availability increased by 190 bps to 2.6% (from

0.7%), mainly due to several floors being made available

for sublease at 157 Lambton Quay. - Two buildings commenced refurbishment and

seismic strengthening: 23 Kate Sheppard Place and 33

Customhouse Quay. 55 Featherston Street completed its

refurbishment, with the Internal Revenue Department

leasing most floors in this building. - The Willis Bond development at 15 Customhouse Quay is

leased to Bell Gully, JLL, Servcorp, and the Eye Institute.

Precinct’s 40 Bowen Street is leased to Ernst and Young,

Fujitsu, Simpson Grierson, Dentons, Aspect Furniture,

and restaurants Little Astoria and Nam, with Generator

occupying the first two floors.

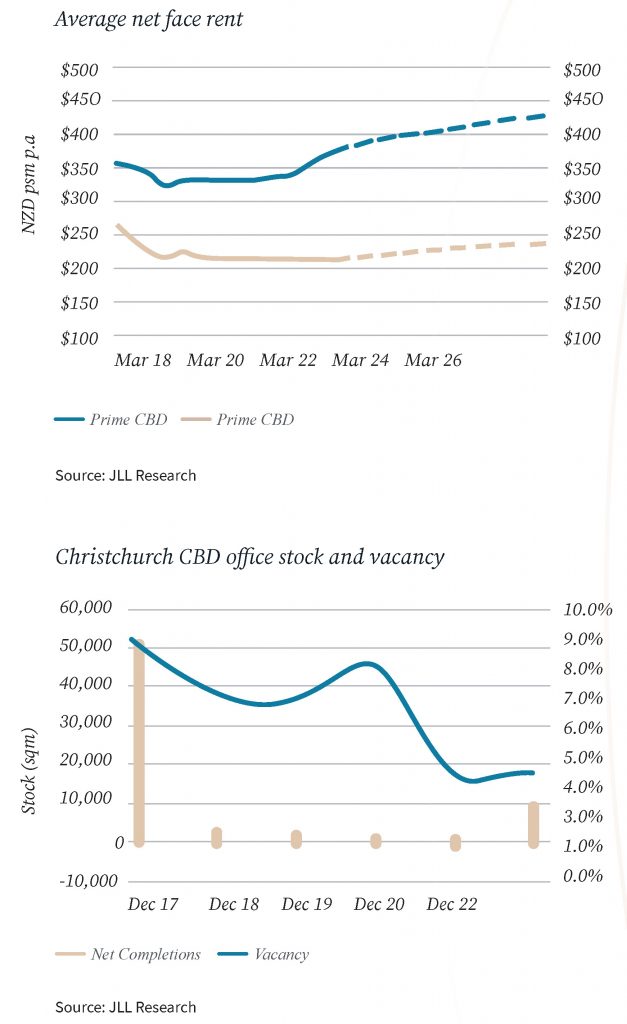

Christchurch

- Christchurch prime office vacancy decreased by 226 bps

to 1.7% (from 4.0%), representing an uptake of ~2,552sqm

of space, demonstrating the high demand for prime office

space in this tight office market. - The city’s reduction in vacancy was a result of two

buildings: 47 Hereford Street, where vacancy dropped

from 37% to 22%, and 62 Worcester Boulevard, where

vacancy dropped from 20% to 0%. - The Garden City has 76% of its A-grade office buildings

standing at 0% vacancy. Sublease space has remained

unchanged at 2,529sqm. Continuing the trend of the CBDs

in this report, there is limited space available for sublease

in Christchurch, apart from a full floor in 215 Tuam Street

and a partial floor at 60 Cashel Street. - After increasing at the end of last year by 4.2%, average

net prime CBD rents remained unchanged during 1Q23

at $375psm. Rents are forecast to increase by 4.0% during

2023, supported by limited new stock coming to market

and continued low vacancy in the Garden City for prime

CBD office space. - Asking rents for new builds are expected to be around

$425psm to be attractive to both developers and

investors, as construction costs have increased over the

last few years. - The only office-exclusive prime new build in the CBD

in the pipeline is 224 Cashel Street, named the Huadu

Innovation Zone. This is a 14,000sqm building with seven

floors of office space that has been undergoing a full

refurbishment and seismic strengthening and is expected

to be completed in the third quarter of this year.

About JLL, New Zealand

JLL (NYSE: JLL) is a leading professional services firm that specialises in real estate and investment management. JLL creates opportunities, spaces and sustainable real estate solutions for its clients, people and communities. JLL is a Fortune 500 company with annual revenue of $20.9 billion, operations in over 80 countries and a global workforce of more than 103,000 as of December 31, 2022. For further information, visit jll.nz